What if your investments could change the world?

Easily invest charitable capital to create economic, social, and spiritual transformation.

Purpose-built for impact investing, we provide a streamlined way to fund transformational businesses, make loans to charity, and grow the amount available for future giving.

Impact Foundation Explainer Video

40% Headstart

Get 40%—and up to 50% in some states—of your capital back right away in the form of a charitable tax deduction

Investment Freedom

Select the deals that align with your goals

Compounding Impact

Investing in an impact company accomplishes kingdom good plus returns fuel future giving

Simplified Administration

Impact Foundation handles the paperwork, tax returns, and compliance

Put more charitable capital to work for good.

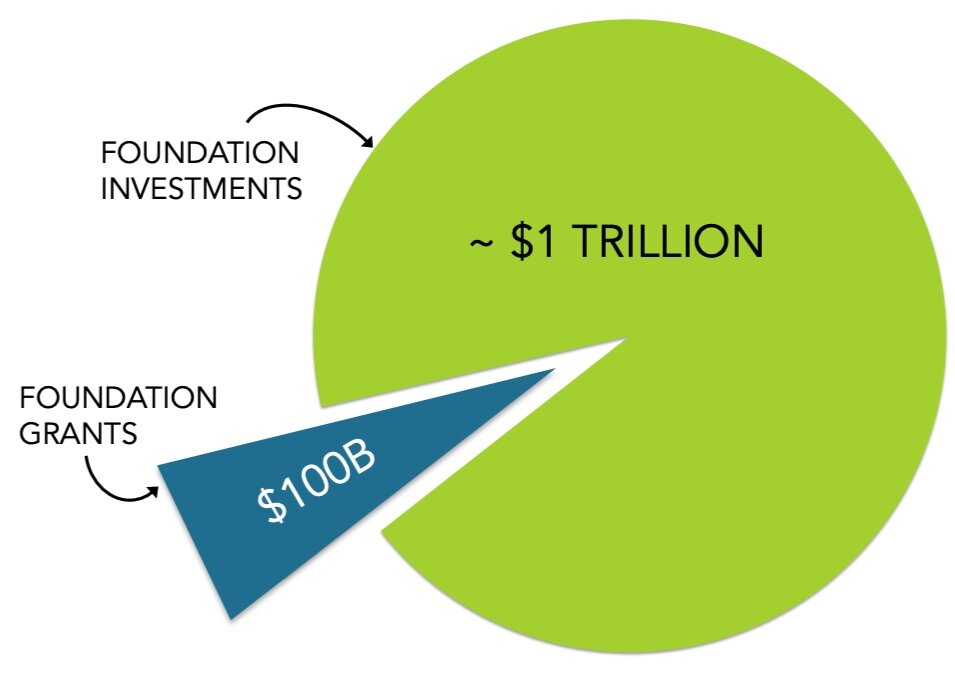

Most charitable assets are invested without regard for mission.

Approximately $1 Trillion has been set aside for gifts to charity in donor advised funds and private foundations. Only 10% is given each year.

Your Impact Account helps you put the rest of those assets to work.

A special kind of donor advised fund from Impact Foundation provides a streamlined way to invest in enterprises that seek social & spiritual transformation while earning financial return to grow your giving.

How it works

An Impact Account lets you put your business and investing talents to work maximizing the impact of your charitable capital through investments in transformational businesses and enterprising charities.

1. Grant to your Account. Establish your Impact Account (a donor advised fund) and grant to it.

2. Recommend Investments. Eligible investments include loans to charity, limited partner interests in a real estate/private equity/venture fund, or direct equity investments.

3. Login and check on the progress of your investments.

4. Returns fuel more good. Financial returns are available for reinvesting or granting to charity.

Can investing really make a difference?

Human trafficking, war, lack of access to the Gospel, extreme poverty—the world is hurting. Generous, innovative families have found that businesses can support solutions to the world’s most difficult problems.

Impact goes beyond grants. God designed His economy to run on the fuel of our generosity and, yet, charity alone cannot solve the world’s toughest issues. In many places, a job is more valuable than a handout.

Business can be a significant force for good. God chooses business people to work in partnership with Him in the renewal of creation. Business has the scale and capacity to affect lasting change.

Impact investing multiplies the opportunity for transformation. The same dollar of charitable capital can make an impact twice: first when invested in a transformational company; then, returns fuel future grants.

Sign up for news and updates.

Get encouraging updates, insightful commentary, and inspiring stories in your email.